Interest income formula

Banks and institutional lenders. Interest principal interest rate term.

Bank Efficiency Ratio Formula Examples With Excel Template

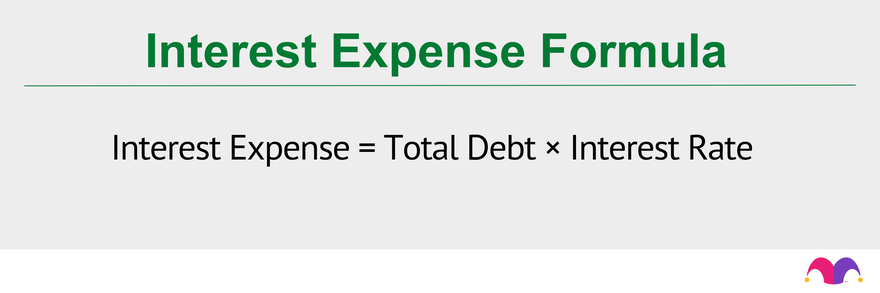

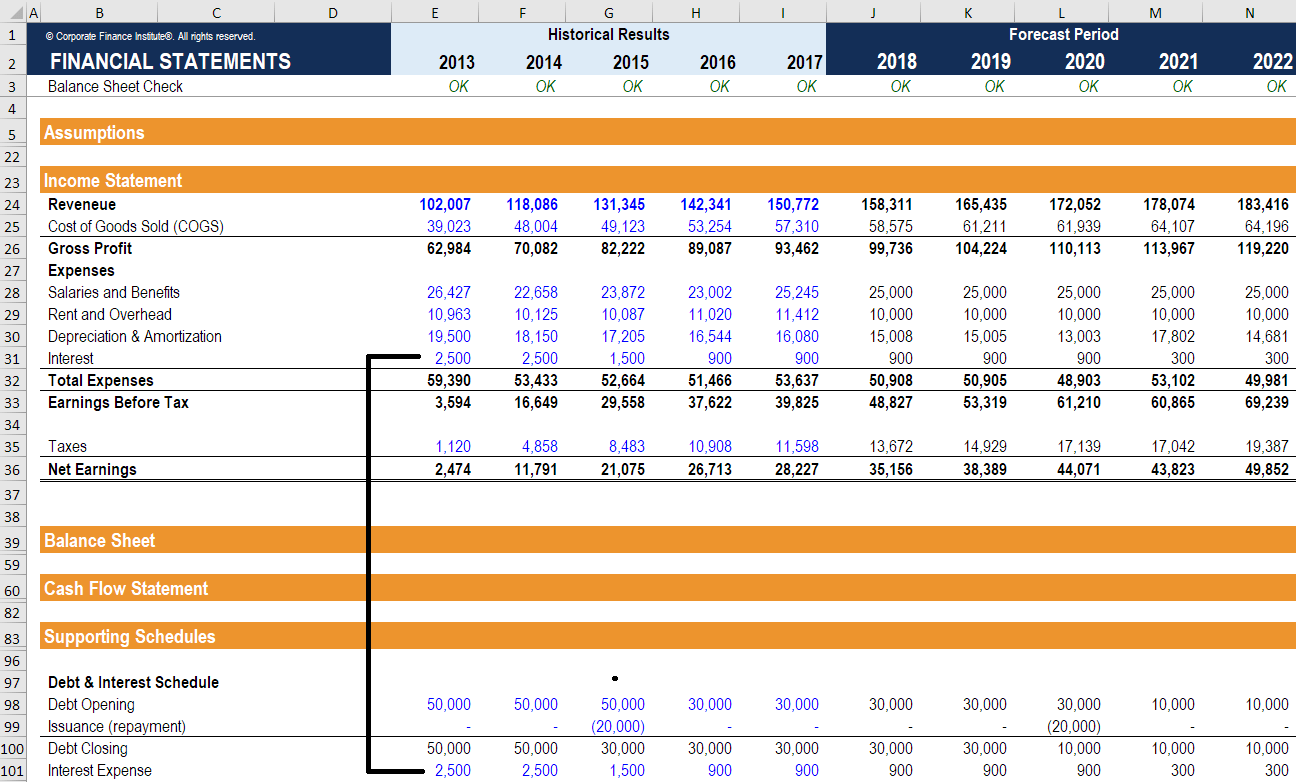

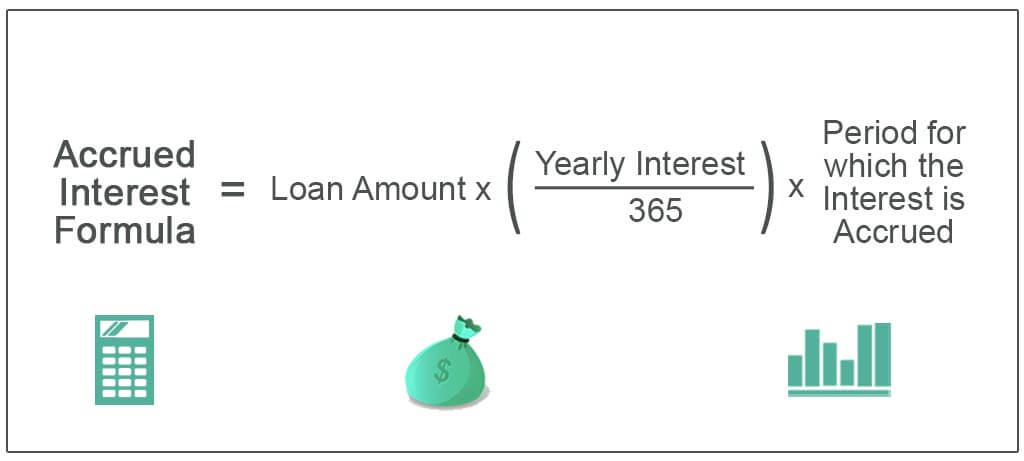

Interest Expense Principal Amount Total Borrowed Amount Rate of Interest Time Period.

. The formula to calculate simple interest is. Interest Yield Formula Interest Yield vs Percent Return on Investment. Net Interest Income Interest Received - Interest Paid.

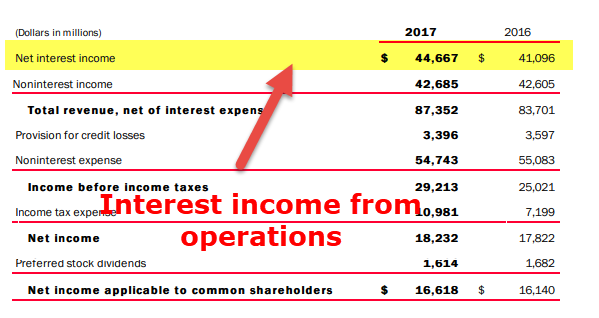

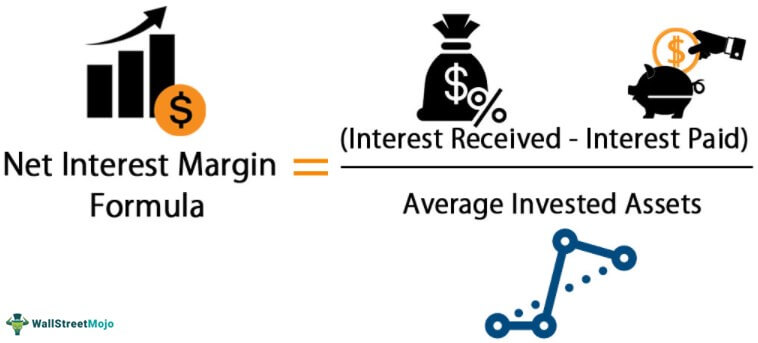

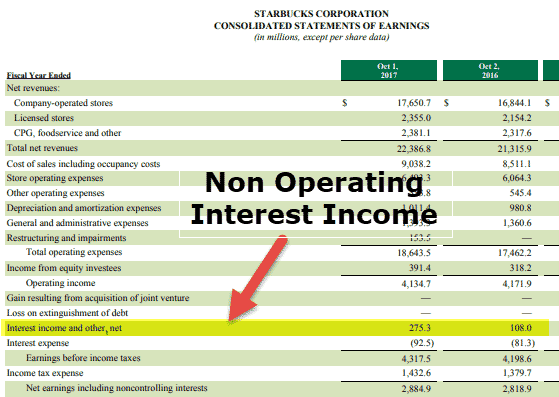

The formula for net interest income is. Non-interest income is bank and creditor income derived primarily from fees including deposit and transaction fees insufficient funds NSF fees annual fees monthly. Unlike the first formula which uses operating income the second formula starts with net.

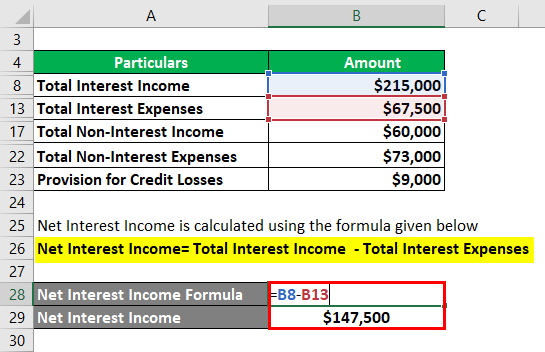

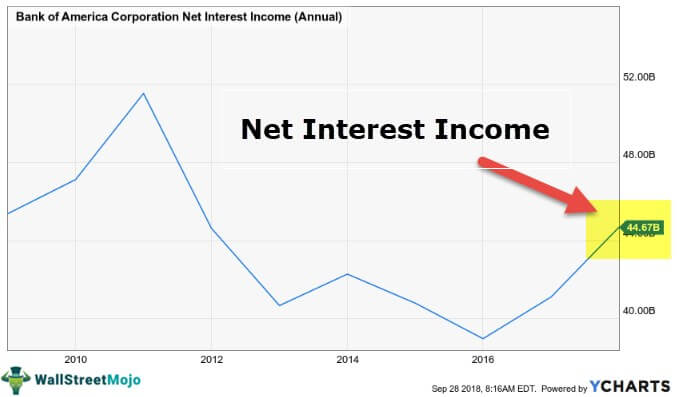

Net interest income is defined as the difference between interest revenues and interest expenses. Interest Expense INR. Net Interest Income NII Formula.

As discussed in the intro a common confusion is mistaking interest yield for percent return on investment. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. This income comes from debt instruments or securities.

Interest Income to Total Funds Net interest IncomeTotal Deposits. EBITDA Net Income Taxes Interest Expense Depreciation Amortization. The interest coverage ratio formula is calculated as follows.

Net interest income is the difference between the revenue that is generated from a banks assets and the expenses associated with paying out its liabilities. The interest received from the investment would be 125200 100000 25200. Interest revenues are payments that the bank receives from.

Interest income refers to the money generated from lending funds to another entity. Learn how to calculate interest expense. This balance is multiplied by the debts interest rate to find the expense.

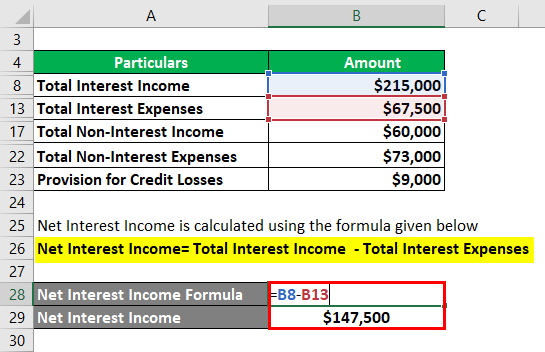

The total interest income total interest expense and net. Net interest income is a measure of profitability most often used within the financial sector eg. Suppose a bank ABC has net interest-earning of Rs.

Using the Net Interest Margin formula we get NIM Interest Received Interest Paid Average. The net interest income formula is used to calculate the amount of interest income that is left after covering interest expenses. Do Your Investments Align with Your Goals.

100000 and its total. Derek owes the bank 120 two years later 100 for the principal and 20 as interest. EBIT is the companys operating profit.

Capital leases are not typically found in the debt schedule. The income statement of Company A is provided below. Lets assume XYZ Bank earns 1000000 for the month on its mortgage loans.

Interest Expense is calculated using the formula given below. Find a Dedicated Financial Advisor Now.

Interest Income Definition Example How To Account

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

Interest Formula Calculator Examples With Excel Template

Interest Expense Formula How To Calculate

Interest Expense How To Calculate Interest With An Example

Fixed Interest Rate Formula And Loan Pricing Calculator Excel Template

Net Interest Income Financial Edge

Accrued Interest Formula Calculate Monthly Yearly Accrued Interest

Net Interest Margin Meaning Formula How To Calculate Nim

Net Interest Income Nii Formula And Calculator Excel Template

Net Interest Income Nii Formula And Calculator Excel Template

Accrued Interest What It Is And How It S Calculated

Interest Income Definition Example How To Account

Net Interest Income Overview And How To Calculate It

Interest Income Definition Example How To Account

Compound Interest Formula With Calculator

Net Interest Income Nii Formula And Calculator Excel Template